Understanding Financial Offshore Accounts and Its Role in Fiscal Optimization

Understanding Financial Offshore Accounts and Its Role in Fiscal Optimization

Blog Article

Why You Need To Consider Financial Offshore Options for Asset Security

In a period noted by financial variations and growing lawsuits risks, people looking for durable property defense might locate relief in offshore financial options (financial offshore). These alternatives not just offer enhanced privacy and potentially lower tax rates but also create a tactical buffer against domestic monetary instability. By checking out diverse investment landscapes in politically and economically stable countries, one can achieve an extra safe and secure economic ground. This approach prompts a reconsideration of asset monitoring techniques, prompting a more detailed check out exactly how offshore techniques might offer lasting economic objectives.

Comprehending the Basics of Offshore Financial and Investing

While several individuals seek to boost their monetary security and privacy, overseas financial and investing emerge as feasible approaches worth thinking about. Offshore financial refers to taking care of financial possessions in institutions located outside one's home nation, often in jurisdictions understood for desirable regulatory environments.

These financial approaches are especially eye-catching for those intending to secure assets from economic instability in their home nation or to access to investment products not readily available locally. Offshore accounts could also supply stronger asset defense versus legal judgments, potentially guarding wealth a lot more effectively. Nevertheless, it's crucial to comprehend that while overseas banking can supply significant benefits, it additionally involves complicated factors to consider such as recognizing foreign monetary systems and browsing exchange price variants.

Lawful Considerations and Compliance in Offshore Financial Activities

Key conformity concerns include sticking to the Foreign Account Tax Conformity Act (FATCA) in the United States, which requires coverage of foreign monetary assets, and the Usual Reporting Requirement (CRS) set by the OECD, which includes info sharing between countries to battle tax evasion. In addition, individuals have to know anti-money laundering (AML) regulations and know-your-customer (KYC) policies, which are rigorous in numerous territories to stop prohibited activities.

Recognizing these legal details is important for keeping the legitimacy and safety of overseas financial interactions. Proper legal support is essential to make sure complete conformity and to optimize the advantages of overseas financial techniques.

Comparing Residential and Offshore Financial Opportunities

Comprehending the lawful intricacies of offshore financial activities assists capitalists recognize the differences between domestic and overseas monetary opportunities. Domestically, financiers are usually more familiar with the regulative atmosphere, which can use a complacency and simplicity of access. U.S. banks and investment firms operate under well-established legal frameworks, providing clear standards on taxes and capitalist defense.

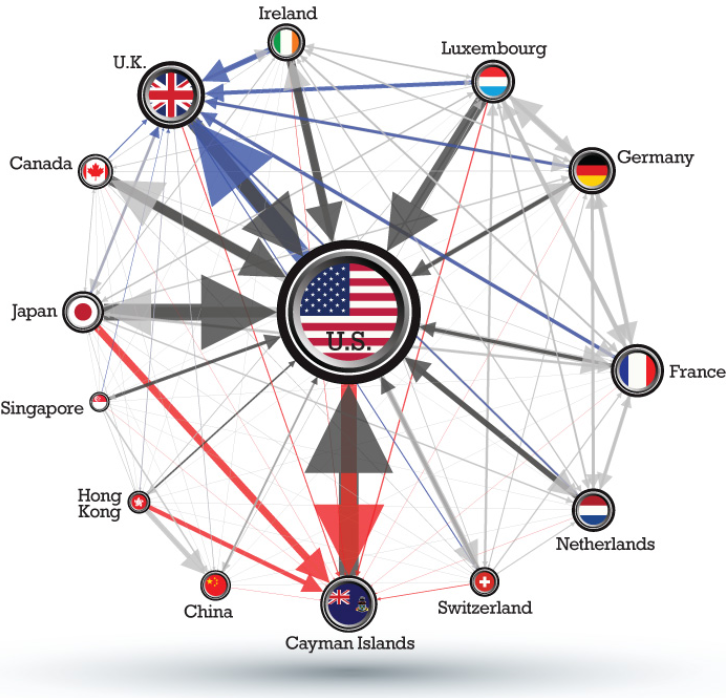

Offshore economic possibilities, nevertheless, commonly provide greater privacy and possibly reduced tax obligation rates, which can be beneficial for asset protection and development. Territories like the Cayman Islands or Luxembourg are prominent because of their beneficial fiscal policies and discernment. These advantages come with obstacles, consisting of boosted scrutiny from international governing bodies and the complexity of managing financial investments across various legal systems.

Investors have to evaluate these elements carefully. The option in between domestic and offshore alternatives must align with their economic goals, risk resistance, and the legal landscape of the corresponding jurisdictions.

Steps to Begin Your Offshore Financial Trip

Embarking on an overseas financial trip requires cautious planning and adherence to legal standards. Individuals need to first carry out comprehensive study to identify ideal countries that use durable financial solutions and favorable legal structures for asset security. This entails assessing the political security, financial environment, and the certain regulations associated with overseas economic activities in potential nations.

The following step is to seek advice from an economic expert or legal professional that concentrates on international financing and taxes. These professionals navigate to this website can provide customized guidance, making sure conformity with both home nation and global laws, which is important for preventing lawful effects.

When a suitable jurisdiction is selected, individuals ought to wage establishing the essential financial frameworks. This typically includes opening up savings account and forming check here lawful entities like companies or counts on, depending upon the individual's specific financial objectives and demands. Each action ought to be meticulously recorded to keep openness and help with ongoing conformity with governing demands.

Final Thought

In an era marked by economic variations and expanding litigation dangers, people seeking robust asset defense might locate solace in offshore financial options. financial offshore.Involving in overseas monetary activities necessitates a detailed understanding of lawful structures and regulative compliance throughout various jurisdictions.Understanding the lawful intricacies of offshore financial tasks assists investors recognize the distinctions between domestic and overseas monetary opportunities.Offshore economic chances, nevertheless, generally offer higher privacy and possibly lower tax prices, which can be beneficial for asset security and growth.Getting started on an overseas financial trip needs mindful he has a good point planning and adherence to lawful guidelines

Report this page